Avoiding Trust Account Errors with CosmoLex

Mishandling client money is among the top client complaints about attorneys. When we think of mishandling, we often think first of misappropriation—taking client funds to spend on oneself. But such actions, however sensational, represent a distinct minority of trust account problems. More commonly, problems with law firm trust accounts, also known as IOLTA (“interest on lawyer trust accounts”), arise from errors of expediency and neglect rather than nefarious intent. Still, such errors may prove a serious threat to your firm, your reputation, and even your law license.

Fortunately, legal technology has advanced well beyond ledger books. Today, approachable, feature-rich, web-centric programs make managing law firm trust accounting simpler. CosmoLex, a leader in online law practice management software, includes robust tools that help attorneys address potential trust accounting pitfalls. Furthermore, since these capabilities are built into CosmoLex, you have access to all matter facts and finances in a single, integrated experience.

Guard Against Trust Account Mishaps

Prevent Commingled Funds

Ethical rules require law firms to separate trust account money from operating account money. Money you receive but have not earned, for example, a retainer from Client 1 or a settlement check for Client 2, must go into the trust account. You can move that money from the trust account to your operating account as you earn it, such as working hours on the matter (Client 1) or paying yourself the 30% contingency fee (Client 2). You must also document such movement appropriately.

Each client’s money in trust must be separately accounted for. Using the example above, Client 1’s retainer and Client 2’s settlement amount are not a single pool of money, although they could reside in the same bank account. If your work for Client 1 exhausts the retainer, you cannot continue to withdraw money from the trust account even if there is money in the account from the settlement check. The settlement check money belongs to Client 2. If you continued paying yourself, you’d overdraft Client 1 and misappropriate money owned by Client 2.

Proper trust accounting necessitates coordinating client, matter, and money data. CosmoLex holds all three and automates individual client ledger management to prevent commingling and overdrafting.

Ensure Proper Payments and Timely Disbursements

Building on our example above, when Client 1 signs an engagement agreement and pays your retainer, that payment must be paid into and reside in your trust account until you earn it. Assuming they’re like most Americans, Client 1 may want to pay with plastic.

Your credit card infrastructure must understand the unique complications of trust accounts. CosmoLex’s credit card processing handles tricky situations like chargebacks and disputes, and allocates money, fees, and service charges appropriately for an IOLTA setting.

Similarly, you must timely disburse funds. For some situations, the desire for timeliness is obvious—Client 2 would like his settlement money. In other cases, the need for timeliness is less stark, but no less true. With Client 1, you should move money from the trust account to the operating account as you earn it.

In both cases, you must document the transactions. CosmoLex makes it easy to record disbursements as they are made. Documentation’s value for Client 2 is obvious. But it’s also important for Client 1 because:

- you have an obligation to separate the firm’s money from client money;

- regular, timely transfer of earned money to the operating account smooths firm cash flow; and

- transferring earned money from Client 1’s trust to the operating account promptly informs you when you have exhausted the retainer. It’s then time to send a replenishment request or begin billing Client 1.

Examples of other CosmoLex features that streamline trust account management include:

- Automatic trust-to-operating account transfers;

- Tracking and disbursement of third-party lien claims; and

- Importing of electronic bank statements.

Many of the activities described above affect both the trust account and operating, or general business, account. One of CosmoLex’s great advantages is the ability to present a holistic picture of your billing system (e.g., invoices sent to clients), your trust account (e.g., money you hold on behalf of a client), and your operating account (e.g., your general business ledger). Your view of the business benefits from a compressive portrait possible only with an integrated solution.

Integrated Data Produces Powerful Reports

CosmoLex’s reporting tools make both the tracking of and reporting on trust account activity easy and intuitive. Additionally, CosmoLex provides simplified reporting for recordkeeping and auditing. With CosmoLex, you can run bank reconciliations, including the critically important three-way reconciliation, in just a few clicks, and archive financial data reports for safe-keeping and later review.

Complete trust financial reports include:

- Account balance reports

- Ledger activity summary reports; and

- Ledger transaction reports.

CosmoLex’s effortless trust reconciliations and audit-ready tools ease mandatory trust accounting obligations. Having these trust reports on hand ensures attorneys are prepared in case of an audit.

Avoid Errors and Alleviate Trust Account Burdens with CosmoLex

With comprehensive trust accounting baked into its law practice management software, CosmoLex provides a complete picture of your firm’s matters and activities, helping to:

- Preventing common trust account errors;

- Simplify precise online payments;

- Facilitate prompt distributions;

- Properly record transactions; and

- Effortlessly produce the reports you and your accountant require.

To learn more about using CosmoLex’s legal-specific accounting tools to stay ethically compliant with client money, visit their website.

The post Avoiding Trust Account Errors with CosmoLex appeared first on Lawyerist.

It has been a whirlwind year for the Open AI-backed, generative AI legal tech startup Harvey, which went from a $5 million seed round in November 2022 to a $21 million Series A in April 2023 to an $80 million Series B in December 2023 at a valuation of $715 million. It was a year […]

It has been a whirlwind year for the Open AI-backed, generative AI legal tech startup Harvey, which went from a $5 million seed round in November 2022 to a $21 million Series A in April 2023 to an $80 million Series B in December 2023 at a valuation of $715 million. It was a year […] A new award announced today is intended to recognize and celebrate the visionary contributions shaping the future of knowledge management and innovation in the legal profession. Called the LexPrize Innovation Award, it will be presented at the Knowledge Management & Innovation for Legal (KM&I) conference taking place in New York City in October. Conference organizer […]

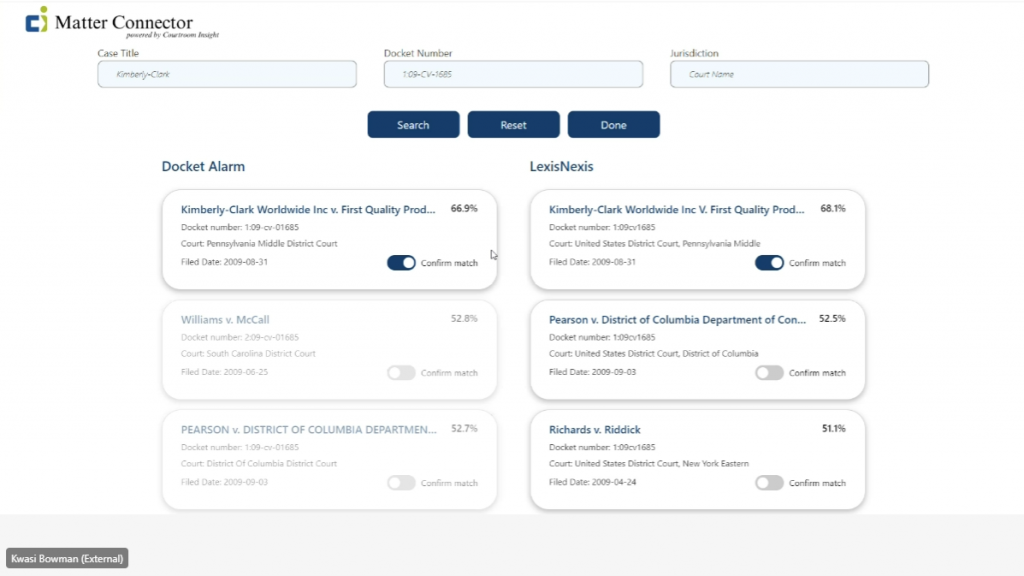

A new award announced today is intended to recognize and celebrate the visionary contributions shaping the future of knowledge management and innovation in the legal profession. Called the LexPrize Innovation Award, it will be presented at the Knowledge Management & Innovation for Legal (KM&I) conference taking place in New York City in October. Conference organizer […] Courtroom Insight today launched Matter Connector, a product that delivers normalized docket data from multiple sources to the knowledge management platform Litera Foundation and to other law firm systems. Matter Connector enables law firms to centralize docket data from major providers, such as LexisNexis, Lex Machina and vLex Docket Alarm, through one unified connector. Using […]

Courtroom Insight today launched Matter Connector, a product that delivers normalized docket data from multiple sources to the knowledge management platform Litera Foundation and to other law firm systems. Matter Connector enables law firms to centralize docket data from major providers, such as LexisNexis, Lex Machina and vLex Docket Alarm, through one unified connector. Using […] According to Upsolve, a nonprofit company whose technology helps low-income individuals file for bankruptcy for free, Americans owe $1.77 trillion in student loan debt — 93% of it to the federal government. Since 2017, Upsolve’s debt relief tools have helped more than 13,000 individuals erase more than $750 million in debt. But, due to the […]

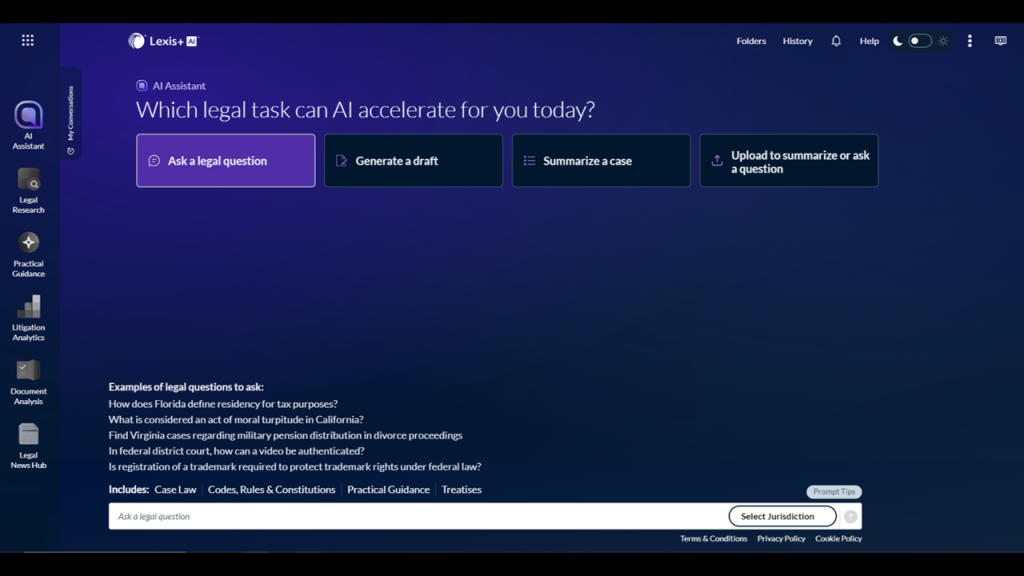

According to Upsolve, a nonprofit company whose technology helps low-income individuals file for bankruptcy for free, Americans owe $1.77 trillion in student loan debt — 93% of it to the federal government. Since 2017, Upsolve’s debt relief tools have helped more than 13,000 individuals erase more than $750 million in debt. But, due to the […] In a pair of AI announcements this week, LexisNexis said that it has significantly enhanced the speed and capabilities of its Lexis+ AI legal AI Assistant, and also that it has launched the commercial preview of Nexis+ AI within its Nexis news and business information research service. LexisNexis first released Lexis+ AI for general availability […]

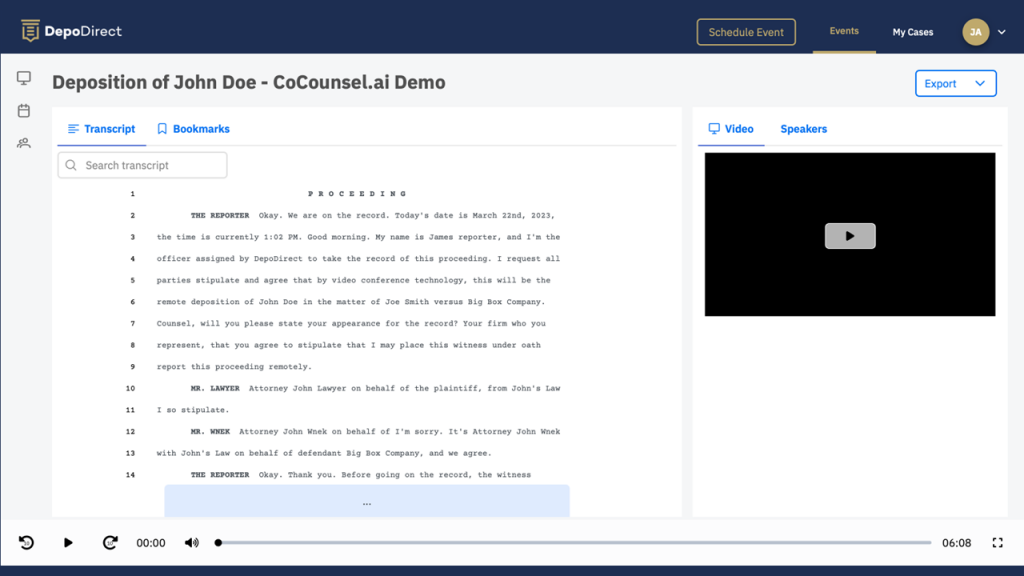

In a pair of AI announcements this week, LexisNexis said that it has significantly enhanced the speed and capabilities of its Lexis+ AI legal AI Assistant, and also that it has launched the commercial preview of Nexis+ AI within its Nexis news and business information research service. LexisNexis first released Lexis+ AI for general availability […] You may have noticed of late that many of your video meetings have an unfamiliar attendee — a meeting bot, invited by one of the human participants, that produces a recording or transcript when the meeting is over. But while there are several such products on the market, none have been developed to meet the […]

You may have noticed of late that many of your video meetings have an unfamiliar attendee — a meeting bot, invited by one of the human participants, that produces a recording or transcript when the meeting is over. But while there are several such products on the market, none have been developed to meet the […] Almost exactly one year ago, a new legal tech startup, The Contract Network, came out of stealth, with a mission to “radically accelerate the time for contract negotiations” through an AI-powered contract collaboration platform where all parties to a deal engage in a secure and neutral environment. The company’s cofounder and CEO, Jim Wagner, is a legal […]

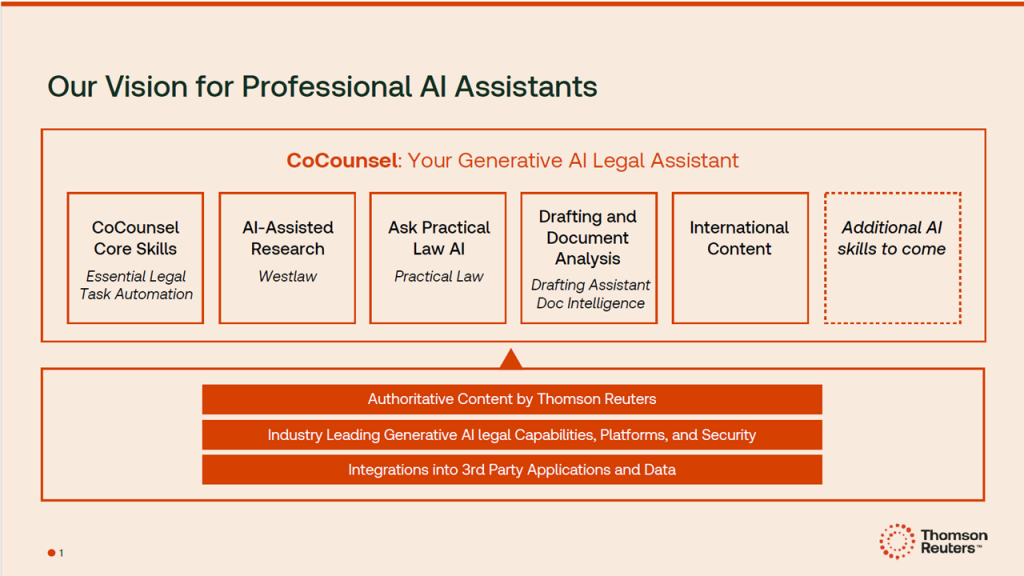

Almost exactly one year ago, a new legal tech startup, The Contract Network, came out of stealth, with a mission to “radically accelerate the time for contract negotiations” through an AI-powered contract collaboration platform where all parties to a deal engage in a secure and neutral environment. The company’s cofounder and CEO, Jim Wagner, is a legal […] Live today on Legaltech Week, the panel will be joined by special guest Jake Heller, cofounder of Casetext and now head of product, CoCounsel, at Thomson Reuters, to discuss the news announced earlier this week that Thomson Reuters will deploy the CoCounsel AI assistant as a single app across its entire portfolio of products spanning […]

Live today on Legaltech Week, the panel will be joined by special guest Jake Heller, cofounder of Casetext and now head of product, CoCounsel, at Thomson Reuters, to discuss the news announced earlier this week that Thomson Reuters will deploy the CoCounsel AI assistant as a single app across its entire portfolio of products spanning […]

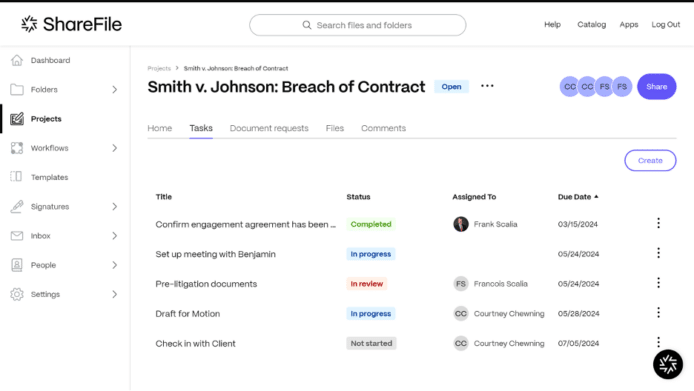

Four years. No institutional capital. An incredible co-founder. Tenacious execution. Lucky timing. And a belief that what we were doing was important. Simply put, it was as rollercoaster. Dashboard Legal was born from a need I remember sitting on the 45th floor of Bank of America Tower, 7 years into a corporate biglaw career, and […]

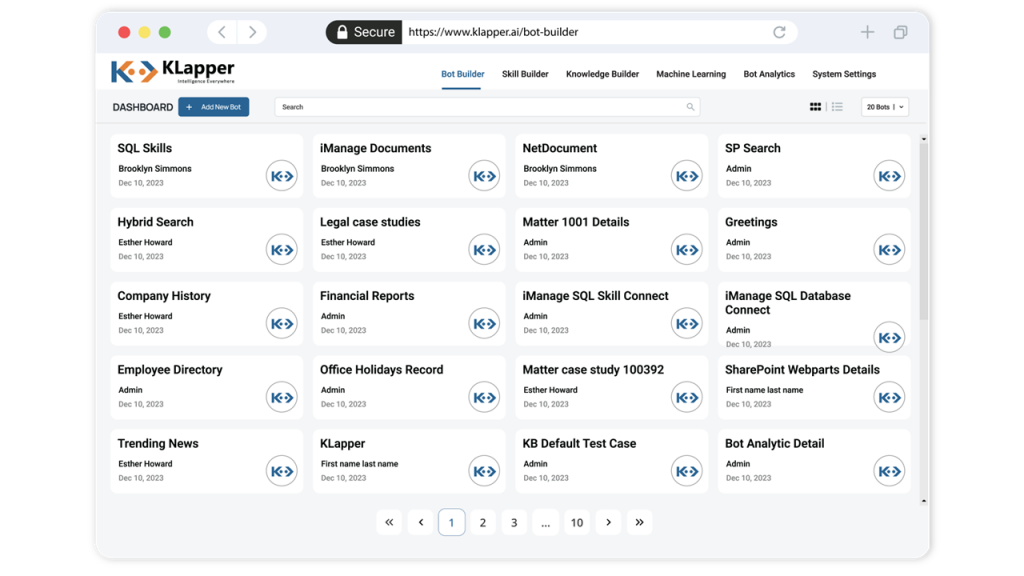

Four years. No institutional capital. An incredible co-founder. Tenacious execution. Lucky timing. And a belief that what we were doing was important. Simply put, it was as rollercoaster. Dashboard Legal was born from a need I remember sitting on the 45th floor of Bank of America Tower, 7 years into a corporate biglaw career, and […] Debuting today is a new product, KLapper, that is a DIY legal virtual assistant builder, powered by generative AI, and designed specifically for law firm knowledge management and innovation teams. Developed by KLoBot Inc., a company that develops knowledge management technology for the legal industry, KLapper was developed to enable users to easily design, train […]

Debuting today is a new product, KLapper, that is a DIY legal virtual assistant builder, powered by generative AI, and designed specifically for law firm knowledge management and innovation teams. Developed by KLoBot Inc., a company that develops knowledge management technology for the legal industry, KLapper was developed to enable users to easily design, train […]

ClaimScore, a startup that uses artificial intelligence to help detect fraudulent claims in class action lawsuits, has closed a $3.15 million seed funding round led by ROC Venture Group, a private investment firm based in Naples, Fla. Founded in 2022, ClaimScore says it is the only software product dedicated to resolving the problem of claims […]

ClaimScore, a startup that uses artificial intelligence to help detect fraudulent claims in class action lawsuits, has closed a $3.15 million seed funding round led by ROC Venture Group, a private investment firm based in Naples, Fla. Founded in 2022, ClaimScore says it is the only software product dedicated to resolving the problem of claims […] Thomson Reuters, continuing to build on its acquisition last June of Casetext and its CoCounsel generative AI legal assistant for a whopping $650 million cash, today disclosed plans to deploy CoCounsel as a single and continuous AI assistant across its entire portfolio of products spanning every professional its serves in legal, tax, risk and fraud, […]

Thomson Reuters, continuing to build on its acquisition last June of Casetext and its CoCounsel generative AI legal assistant for a whopping $650 million cash, today disclosed plans to deploy CoCounsel as a single and continuous AI assistant across its entire portfolio of products spanning every professional its serves in legal, tax, risk and fraud, […] With so much focus on the use of large language models in law practice, the Kelvin Large Language Model – or KL3M (pronounced CLEM) for short – stands out as distinct for two reasons. For one, it is the first LLM built entirely from scratch specifically for the legal market. In addition, it is the first LLM […]

With so much focus on the use of large language models in law practice, the Kelvin Large Language Model – or KL3M (pronounced CLEM) for short – stands out as distinct for two reasons. For one, it is the first LLM built entirely from scratch specifically for the legal market. In addition, it is the first LLM […] Every year, the International Academy of Digital Arts & Sciences (IADAS) hands out its Webby Awards, which honor excellence on the internet and recognize influential creators and brands. There are actually two awards — The Webby Award selected by IADAS and The Webby People’s Voice Award, voted on by the online community of people like […]

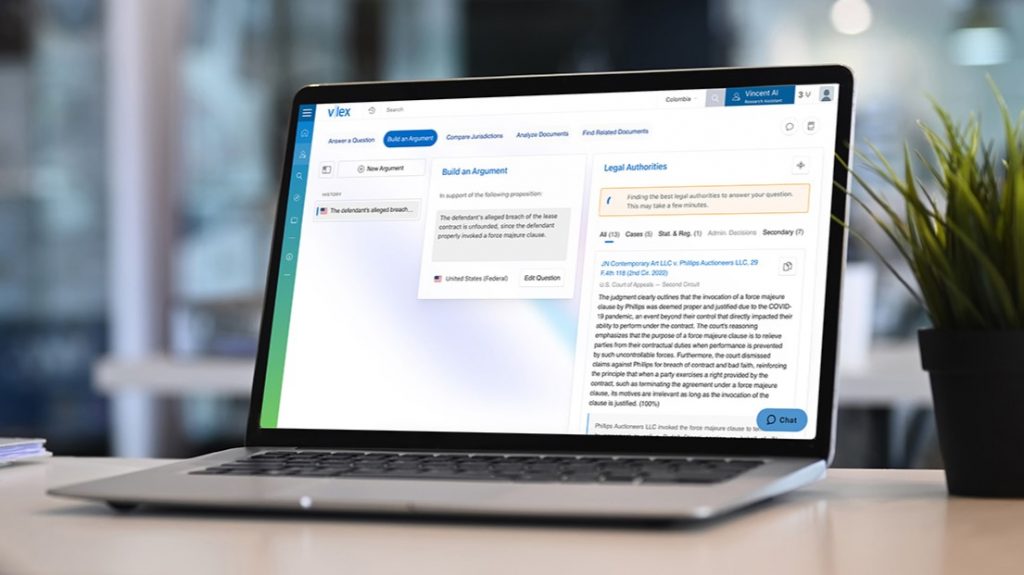

Every year, the International Academy of Digital Arts & Sciences (IADAS) hands out its Webby Awards, which honor excellence on the internet and recognize influential creators and brands. There are actually two awards — The Webby Award selected by IADAS and The Webby People’s Voice Award, voted on by the online community of people like […] The global legal research company vLex today announced the launch of Vincent AI Document Analyze, a new tool in its suite of generative AI features that enables legal professionals to analyze litigation and transactional documents and surface legal and factual information that they can use in preparing a response. Also today, vLex said it has […]

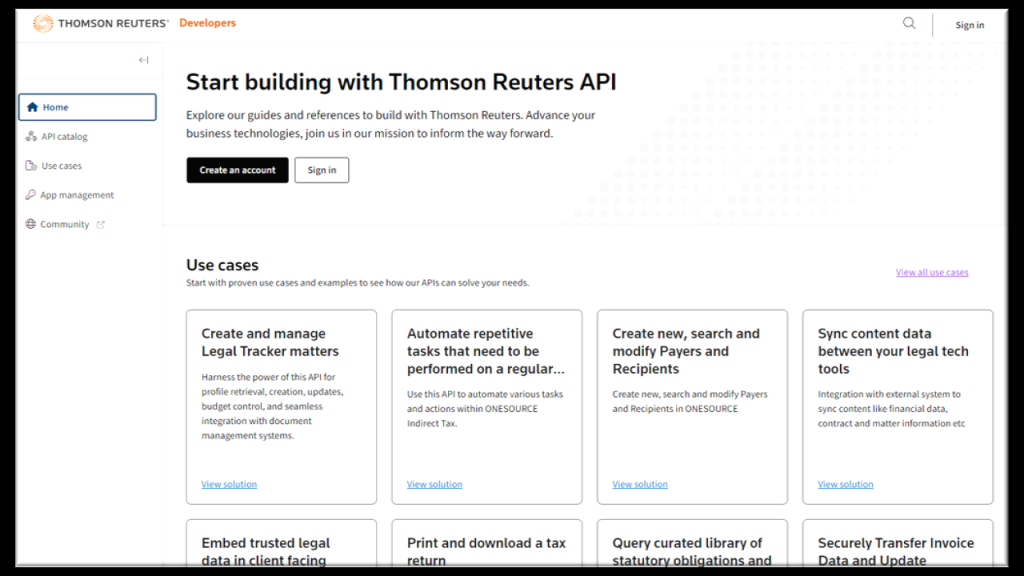

The global legal research company vLex today announced the launch of Vincent AI Document Analyze, a new tool in its suite of generative AI features that enables legal professionals to analyze litigation and transactional documents and surface legal and factual information that they can use in preparing a response. Also today, vLex said it has […] Thomson Reuters has launched a global Developer Portal giving access to over 100 APIs, providing tax, legal, risk and fraud professionals with tools to more easily integrate their workflows with the company’s technology, data, content and insights. TR says that, by providing developers with API access to its data and insights, the portal should serve as […]

Thomson Reuters has launched a global Developer Portal giving access to over 100 APIs, providing tax, legal, risk and fraud professionals with tools to more easily integrate their workflows with the company’s technology, data, content and insights. TR says that, by providing developers with API access to its data and insights, the portal should serve as […] Two teams of law students, as part of their education at Brigham Young University Law School, have developed applications targeting issues of access to justice, and today, on the last day of classes, they will showcase what they have built at a special event expected to be attended by members of the local legal and […]

Two teams of law students, as part of their education at Brigham Young University Law School, have developed applications targeting issues of access to justice, and today, on the last day of classes, they will showcase what they have built at a special event expected to be attended by members of the local legal and […]