Thomson Reuters today delivered on its promise to integrate generative AI within its flagship legal research platform, introducing AI Assisted Research in Westlaw Precision, available immediately to all U.S. Precision customers at no extra cost.

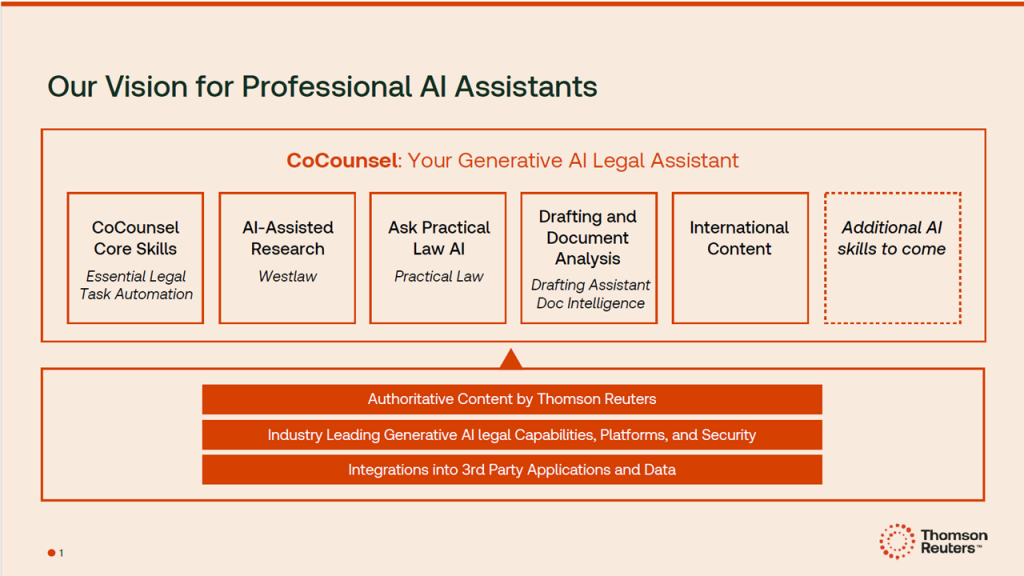

It also previewed its coming integration of Casetext CoCounsel as an AI legal assistant across multiple TR products, including Westlaw Precision, Practical Law, Document Intelligence, and HighQ. As of today, Westlaw Precision users can directly access CoCounsel through a button in the navigation bar.

Starting in 2024, TR will begin adding AI-assisted research to Westlaw in markets outside the U.S., starting with the UK, Canada, Australia, and New Zealand.

CoCounsel will also remain available for purchase as a standalone application, called CoCounsel Core.

In addition, TR announced the beta version of its integration of generative AI into Practical Law, a feature that will be released in the first quarter of next year.

‘Transformational Change’

All of these developments were previewed yesterday to members of the media during a briefing by TR executives in the company’s Times Square office in New York.

Of all the announcements covered during the briefing, David Wong, TR’s chief product officer, said the launch of AI-assisted research in Precision was “the headline today.”

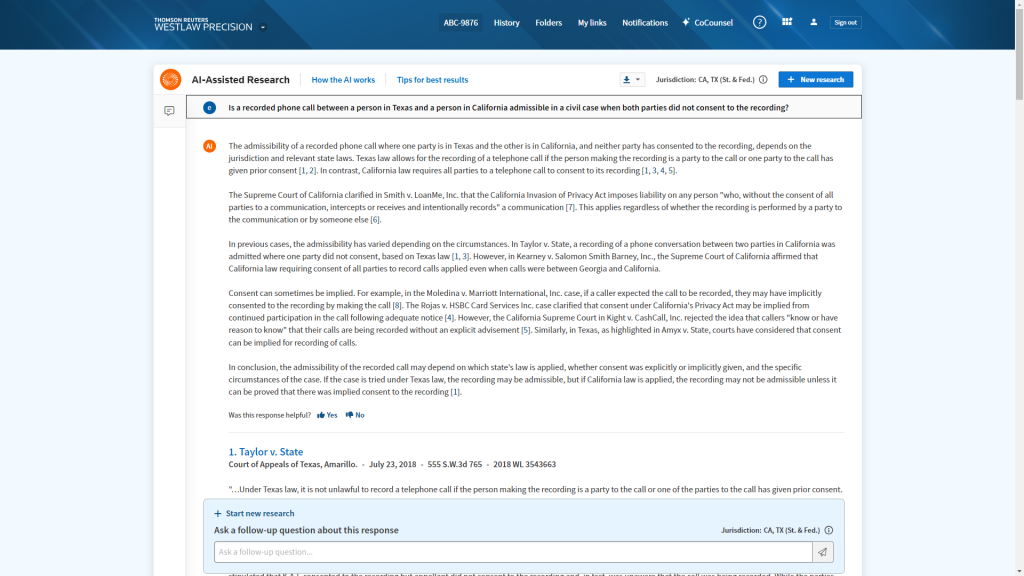

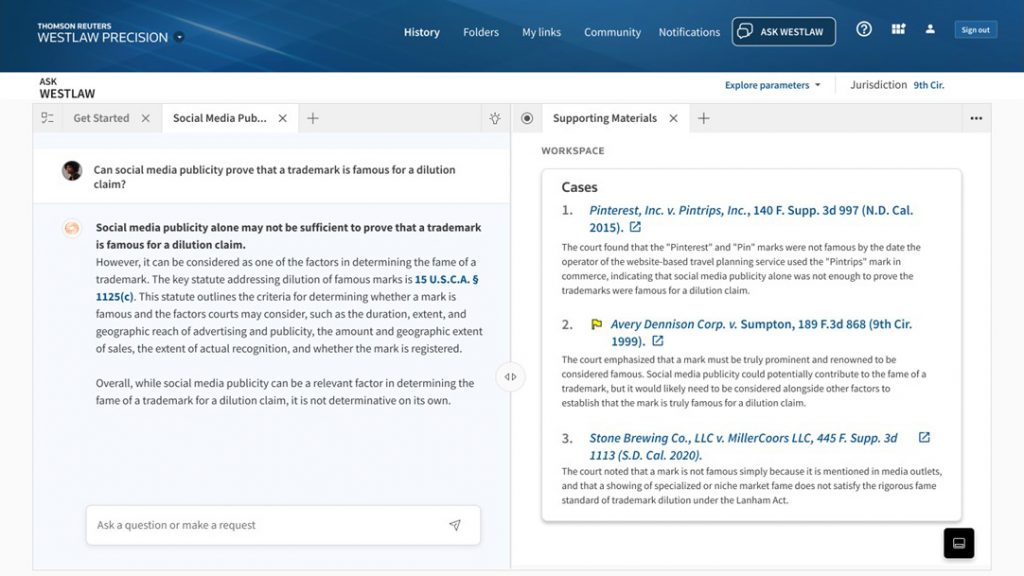

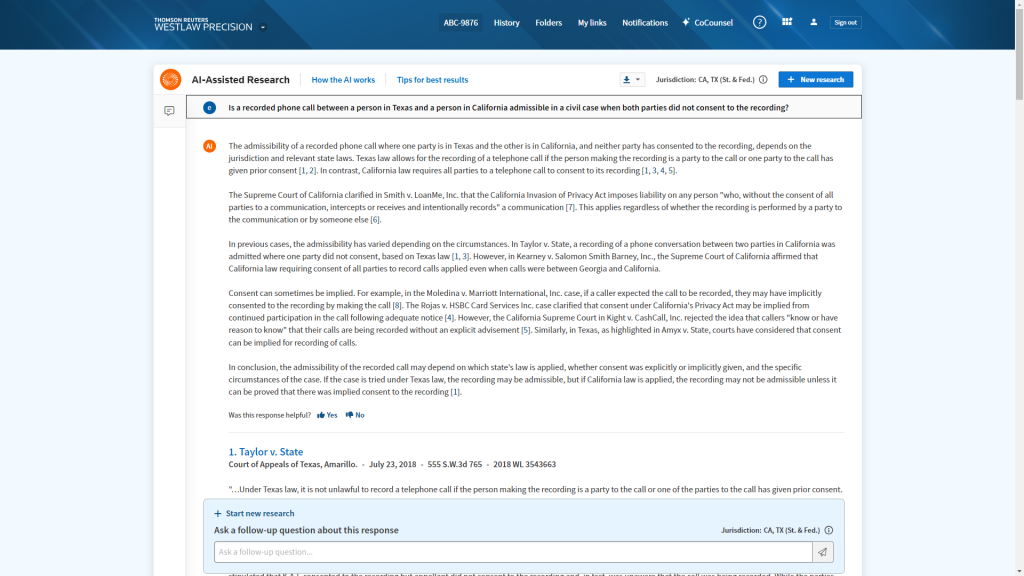

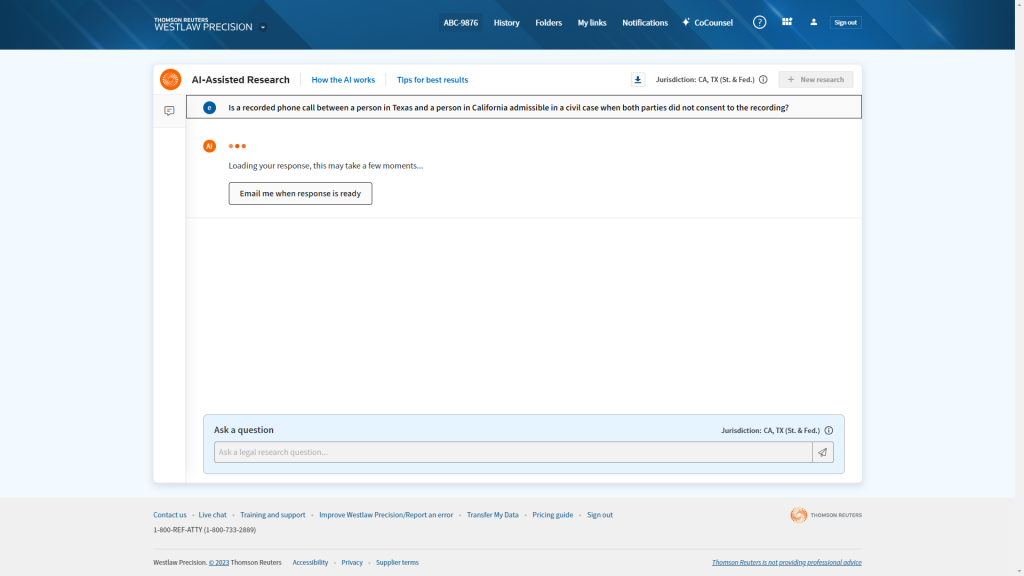

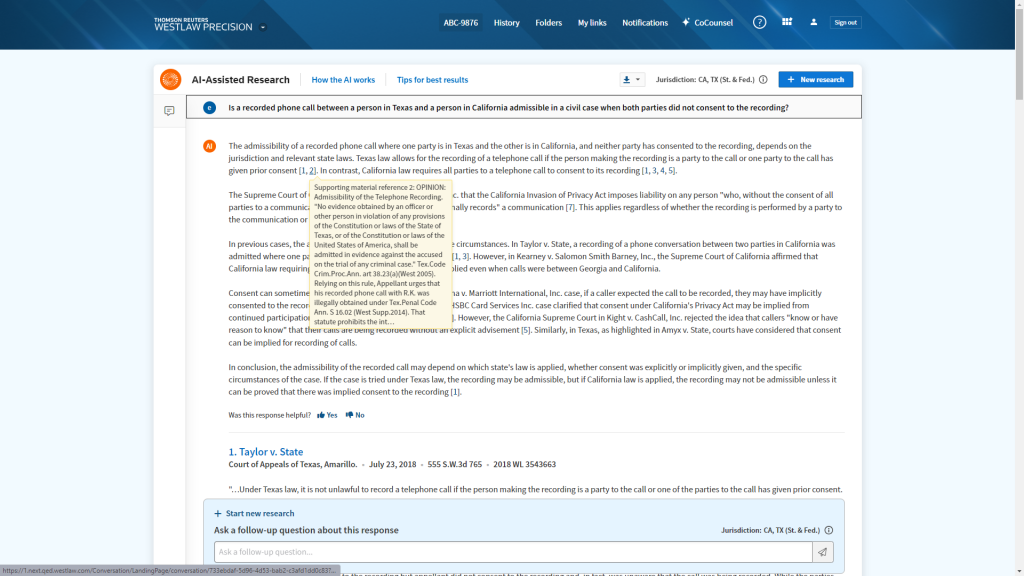

An answer provided by AI-Assisted Research.

Mike Dahn, SVP and head of Westlaw product management, went even farther, calling the launch “the biggest transformational change in legal research since the move from books to online legal research.”

The key to that change — and what makes AI-Assisted Research different from traditional research — is in how it processes and delivers results. In traditional legal research, the user enters a query and gets a response in the form of a long list of cases, statutes and other resources. It is then up to the user to plod through it all in search of the answer.

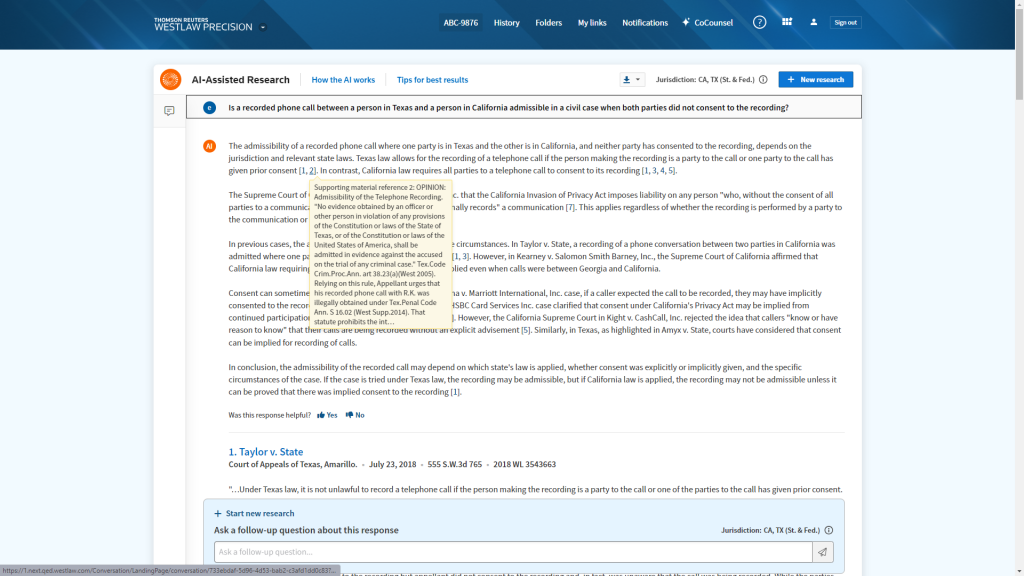

With AI-Assisted Research, the user asks a question and the AI delivers an answer in the form of a narrative. No more plodding through cases. The narrative includes footnotes pointing to the cases or other materials on which it bases its answer. Hover over a footnote to see the case and an excerpt. Click on the footnote to see the case, or scroll down on the page to see the full list of results.

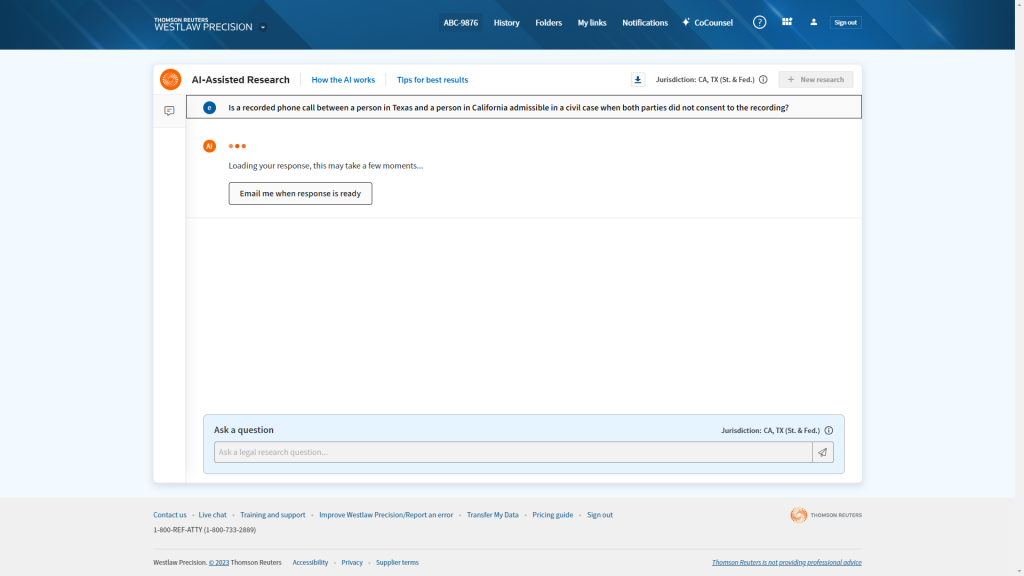

Although it can take more than 90 seconds to deliver an answer, it offers users the option of emailing them when the answer is ready.

Because there is a lot of computing going on in the background here, AI-Assisted Research takes longer to deliver its answer than traditional research – anywhere from 90 seconds to three minutes. But Dahn says beta users have so far not put off by this, because they appreciate how much time they save when they do receive the answer.

Behind the scenes, the AI in Westlaw is using retrieval augmented generation (RAG). That means that it uses traditional research methods to pull relevant resources out of Westlaw, which it then sends to the large language model (LLM) to analyze and generate an answer.

Answers contain footnotes to sources relied on. Hover over one to see the context.

For its LLMs, TR is using a combination of Microsoft Azure OpenAI and a direct commercial API to OpenAI’s GPT-4. Importantly, TR says no user data is being directly shared outside the TR environment.

A future release of the AI tool will also allow a researcher to summarize groups of cases. When a headnote lists a number of cases as supporting authorities, the user can click a button to summarize all the cases and make them easier to review.

There are other AI-assisted legal research products already on the market – most notably from LexisNexis, which released its Lexis+ AI last month, and vLex, which also last month released the beta of its generative AI legal research tool. But TR maintains that its is superior to others for two reasons – the quality of its discovery process and the quality of its content.

The quality of the process, TR says, comes from Westlaw’s proven and long-established legal research platform. The quality of the content comes from both the depth of Westlaw’s content as well as its enhancements through KeyCite, Key Numbers, Headnotes and Precision research.

As of today’s launch, the AI research tool draws only from primary law materials in Westlaw, such as cases, statutes and regulations. TR says that it will soon bring secondary materials such as treatises into the mix.

An advantage of this RAG approach is that it minimizes the risk of hallucinations, because it draws its answers from trusted content. But Dahn says hallucinations are not the primary problem with generative AI research. Rather, the bigger problem is accuracy, in that an answer can be free of hallucinations but nevertheless wrong.

“Our focus is on delivering accurate results,” Dahn said. “Hallucination-free is a relatively low bar, but accuracy is more important.”

Even so, the speakers at TR’s briefing uniformly emphasized that AI-Assisted Research is a tool that can supplement and enhance research, but that should not be viewed as a replacement for traditional research. In fact, the welcome page includes this disclaimer:

“AI-Assisted Research uses large language models and can occasionally produce inaccuracies, so it should always be used as part of a research process in in connection with additional research to fully understand the nuance of the issues and further improve accuracy.”

There are also certain types of research that this product does not support. Examples provided by TR include:

- Searching by citation.

- Boolean or fielded queries.

- Questions about particular documents, such as “Does the Jones v. Smith case include a situation with a supervisor as a defendant?”

- Requests for analytics, such as “Which law firm has the most torts cases in 2023 so far?”

- Commands to execute certain tasks, such as “Email me the Jones v. Smith case and any cases that have negative KeyCite treatment.”

- Requests for comprehensive document retrievals, such as “Find all cases granting summary judgment on negligent misrepresentation claims.”

- Instructions to filter supporting authority, such as “Exclude any unpublished cases or criminal regulations.”

- Requests for timing or mathematical calculations, such as “By which date do I need to file a notice of appeal for a judgment entered on July 8th.”

- Questions about predictions of outcomes, such as “Will the Supreme Court overturn the Chevron doctrine?”

- Requested comparisons across many jurisdictions, such as “How does each state address the privacy of data stored on a mobile device?”

Casetext CoCounsel

Ever since last June, when TR announced that it would pay $650 million to acquire Casetext and its CoCounsel product, the first AI legal assistant developed in partnership with OpenAI, curiosity has been rampant over how TR would integrate the technology.

Now we know more details.

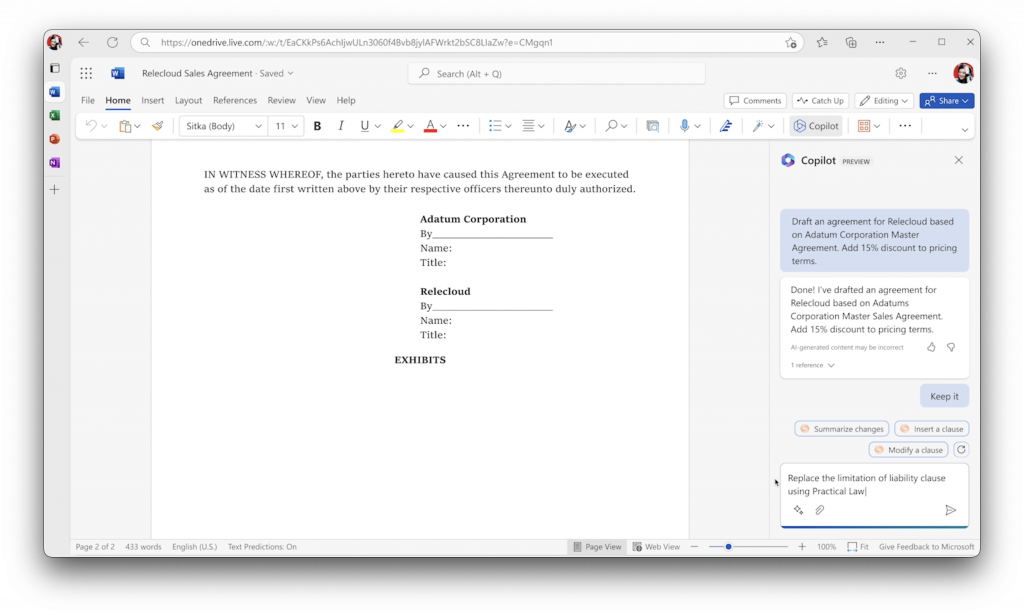

TR said it will be integrating CoCounsel’s legal assistant throughout its legal products, including Westlaw Precision, Practical Law Dynamic Tool Set, Document Intelligence, and HighQ. CoCounsel will also remain available as a standalone application.

CoCounsel offers a set of “skills” that enable users to perform tasks that include prepare for a deposition, draft correspondence, search a database, review documents, summarize a document, extract contract data, and determine contract policy compliance.

Jake Heller, Casetext’s cofounder and now head of product for CoCounsel at TR, said other skills are being developed to address customer-specific needs.

“Today, CoCounsel is the first and best AI legal assistant,” Heller said at yesterday’s briefing. “As an attorney, I can delegate complex substantive work to my AI assistant and expect it to be done at human or superhuman speed and with human or superhuman accuracy.”

Heller demonstrated how the generative AI capabilities of CoCounsel allow it to answer questions that would have been unheard of with traditional search. Upload a set of documents, such as a collection of emails, and ask, “Do these documents contain a joke?” CoCounsel can answer that question, something that search could never have done before.

One new skill launching today in beta within CoCounsel is the ability to create timelines. Users will be able to upload a set of documents and create a chronology of events.

AI in Practical Law

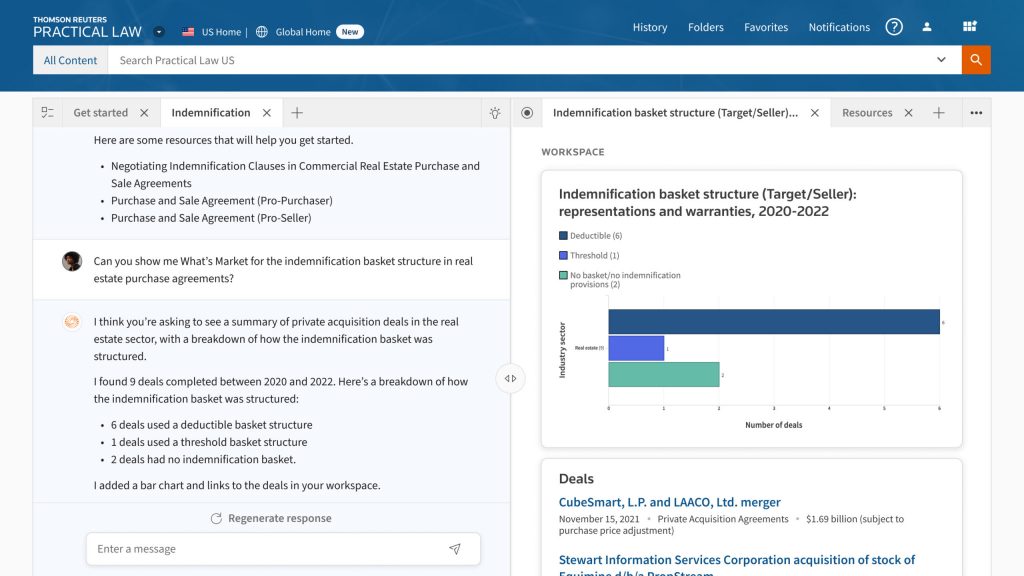

At yesterday’s briefing, Emily Colbert, head of product management, know how and compliance, demonstrated the newly released beta version of a conversational AI interface for Practical Law (PL). The feature will become generally available in the first quarter of 2024.

A user will be able to find PL content by asking a simple query. The interface will read through PL’s resources and provide an answer, together with the sources within PL on which it based the answer.

The conversational interface makes it easier for users to find answers in practice areas or on topics with which they are not highly familiar. It can also sometimes find on-point resources from less-than-obvious topics within PL.

While this beta version uses generative AI to improve customer access to expertise, Colbert said future versions will unlock access to even more content and features within PL, and will eventually transform customers’ workflows by delivering access to PL expertise wherever they are working.

“We’d like to bring that expertise directly into customers’ workflows,” she said.

Security and Privacy

Cognizant of customers’ concerns about the security of using generative AI, TR says it protects customers’ data through a comprehensive information security management framework and a range of security policies, standards and practices.

Specifically with regard to AI, it says that it expressly prohibits any vendor from retaining or using Westlaw or Practical Law customer data to train its generative AI model.

Its use of generative AI is through dedicated API access via Microsoft Azure, OpenAI and Amazon Web Services, it says, and it uses a risk-based approach to assess vendors, applications and technologies through a variety of testing and assessment methods.

Bottom Line

“Thomson Reuters is redefining the way legal work is done by delivering a generative AI-based toolkit to enable attorneys to quickly gather deeper insights and deliver a better work product,” said Wong. “AI-Assisted Research on Westlaw Precision and CoCounsel Core provide the most comprehensive set of generative AI skills that attorneys can use across their research and workflow.”

The fact is that legal research providers are in a horse race to bring generative AI to their platforms. On its face, AI-Assisted Research on Westlaw Precision appears not to be much different than the Lexis+ AI product from LexisNexis or Vincent AI from vLex. They all allow the user to ask a question and get a narrative response with links to the source materials that support the response.

TR argues that the quality and depth of its content and the head start provided by its headnotes and taxonomy of Key Numbers mean it can deliver higher-quality answers. Obviously, the proof of that will be in the pudding, as customers begin to use and evaluation the product.

But what TR has going for it over any of its competitors right now is the one-two punch of AI-Assisted Research and CoCounsel, two complementary AI tools that, together, both facilitate legal research and provide an AI “legal assistant” for other common tasks. As Wong said, that creates “a generative AI-based toolkit” for legal professionals that is useful for legal research and beyond.

Thomson Reuters, continuing to build on its acquisition last June of Casetext and its CoCounsel generative AI legal assistant for a whopping $650 million cash, today disclosed plans to deploy CoCounsel as a single and continuous AI assistant across its entire portfolio of products spanning every professional its serves in legal, tax, risk and fraud, […]

Thomson Reuters, continuing to build on its acquisition last June of Casetext and its CoCounsel generative AI legal assistant for a whopping $650 million cash, today disclosed plans to deploy CoCounsel as a single and continuous AI assistant across its entire portfolio of products spanning every professional its serves in legal, tax, risk and fraud, […]

Thomson Reuters has launched a global Developer Portal giving access to over 100 APIs, providing tax, legal, risk and fraud professionals with tools to more easily integrate their workflows with the company’s technology, data, content and insights. TR says that, by providing developers with API access to its data and insights, the portal should serve as […]

Thomson Reuters has launched a global Developer Portal giving access to over 100 APIs, providing tax, legal, risk and fraud professionals with tools to more easily integrate their workflows with the company’s technology, data, content and insights. TR says that, by providing developers with API access to its data and insights, the portal should serve as […] On this episode of LawNext: A conversation about Thomson Reuters’ strategy around generative artificial intelligence with two of the executives most directly responsible for its development and implementation. In a year dominated by discussion of generative AI and its potential impact on the legal profession, Thomson Reuters has played a leading role. It started in […]

On this episode of LawNext: A conversation about Thomson Reuters’ strategy around generative artificial intelligence with two of the executives most directly responsible for its development and implementation. In a year dominated by discussion of generative AI and its potential impact on the legal profession, Thomson Reuters has played a leading role. It started in […] Still less than a year since it launched, CoCounsel, the generative AI legal assistant originally developed by Casetext, has had quite a year. Now, as it expands into new markets, we get details on its adoption to date. It was March 1, 2023, that Casetext launched CoCounsel, a product developed in partnership with OpenAI that […]

Still less than a year since it launched, CoCounsel, the generative AI legal assistant originally developed by Casetext, has had quite a year. Now, as it expands into new markets, we get details on its adoption to date. It was March 1, 2023, that Casetext launched CoCounsel, a product developed in partnership with OpenAI that […] Thomson Reuters is shutting down its Firm Central law practice management software and will discontinue support for the product after Sept. 30, 2024. Thomson Reuters launched Firm Central in 2013 at a media event in its then-headquarters in Eagan, Minn., as its answer to a then-growing crop of cloud-based practice management software such as Clio, […]

Thomson Reuters is shutting down its Firm Central law practice management software and will discontinue support for the product after Sept. 30, 2024. Thomson Reuters launched Firm Central in 2013 at a media event in its then-headquarters in Eagan, Minn., as its answer to a then-growing crop of cloud-based practice management software such as Clio, […] In November, when Thomson Reuters announced the integration of generative AI within its flagship legal research platform Westlaw Precision, it also announced the beta version of a generative AI integration within Practical Law. Today, Thomson Reuters is formally releasing that generative AI feature in Practical Law, called Ask Practical Law AI, and also releasing a […]

In November, when Thomson Reuters announced the integration of generative AI within its flagship legal research platform Westlaw Precision, it also announced the beta version of a generative AI integration within Practical Law. Today, Thomson Reuters is formally releasing that generative AI feature in Practical Law, called Ask Practical Law AI, and also releasing a […]

1.

1. 2.

2. 3.

3. 4.

4. 5.

5. 6.

6. 7.

7.

9.

9. 10.

10. 11.

11. 12.

12. 13.

13. 14.

14. 15.

15.

2.

2. 3.

3. 4.

4. 5.

5. 6.

6.

8.

8. 9.

9. 10.

10. 11.

11. 12.

12. 13.

13. 14.

14. 15.

15.