Yesterday afternoon, I had the chance to sit down for about 20 minutes via Zoom with Jake Heller, the founder and CEO of Casetext, to discuss his company’s acquisition by Thomson Reuters in a $650 million cash deal.

What follows is a transcript of our conversation, which I have condensed and edited very slightly for style and continuity.

References to the morning investors’ call are to yesterday morning’s briefing by Thomson Reuters to its institutional investors, which I wrote about here.

A Stanford Law School graduate, where he was president of the Stanford Law Review, Heller founded Casetext in 2013 after stints clerking for 1st U.S. Circuit Court of Appeals Judge Michael Boudin and as an associate at law firm Ropes & Gray.

Related: How A Startup Evolves: As Casetext Marks 10th Year Anniversary, Here’s Its History Through 50 Blog Posts.

AMBROGI: Jake, thanks for taking a few minutes. And, again, congratulations. As you know, I’ve followed you guys from the start, and so I’m really excited for all of you on a personal level. But I’m curious about your motivation for entering into this deal. Obviously, you’ve put a lot of blood and sweat into building up this company. On the investor call this morning, the Thomson Reuters executives talked about the strategy behind why they wanted to do the deal. What about from your perspective: Why did you want to do the deal? I’m sure $650 million was a big motivator, but knowing how much you’ve put into the company, I doubt that’s all there is to it.

HELLER: That’s right. We wouldn’t have done anything like this if we didn’t know that it wouldn’t be a good deal not just for the shareholders and the employees, but also for the customers. What really got me excited about this was all the possibilities of what we’re going to build together with our customers.

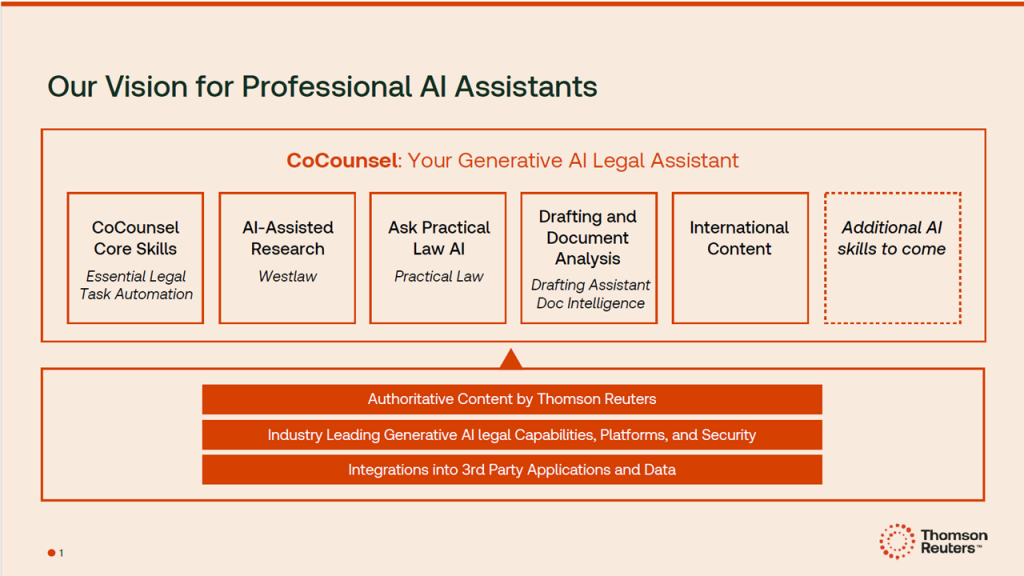

For one, the number one constraint that we have right now is content. On one hand, we know that providing West’s and Thomson Reuters’ world-class content database behind our legal research capability is going to make that dramatically better, including when CoCounsel does legal research activities for you. Having it do that on Thomson Reuters’ content is going to be an immediate benefit to our customers.

But, working with their content, there is much more that we can do. For example, using Practical Law’s content to make drafting automation tools – tools that are already there in the pipeline for us – just dramatically better. And really, that’s just where it starts. We saw an immediately huge gain for our customers just by working with them on this. And what’s even more exciting to me is it’s clear that TR is going to invest very substantially in this type of AI. They’re taking it as seriously as we are, have the resources to accelerate our development in a way that, working separately, neither of us would be able to accomplish in the same way as we could working together.

For that and many other reasons, as we sat around the table discussing what we hope to potentially accomplish together should this deal close, we all got really excited about that.

One last thing here. This is a company that, through acquisitions, brought on products like Westlaw and Practical Law Company. What we saw with those products is evolving over time to become really amazing, high-quality products that have, in many ways, set the standard for what things should look like in the world of legal tech. So we knew that we’re working with folks with the capacity and ability to deeply invest in something that they care about and make it into something that has broader reach and a bigger impact than we’d be otherwise able to do. We could probably get there eventually, but it would be really hard. And on some things like content, we may never get there.So we just see this as a massive acceleration of what we’re able to do together.

AMBROGI: What about from their side? Several of the investors this morning seemed to be asking about why TR made this acquisition versus developing the technology themselves, or why they acquired Casetext over, say, Harvey or some of the other products out there. Looking at it from TR’s perspective, what is it that you think Casetext brings to TR that they couldn’t have done or wouldn’t have done without you?

HELLER: I don’t want to speculate too much about their own position. But I’ll say, from my perspective, we are doing this better, we’re doing this best. We have just done a really good job of building out capabilities – reliable, professional grade AI in use today by thousands of lawyers to transform their practices. And I believe that our technology, some of the breakthroughs that we’ve had, some of the fundamental capabilities on the platform level and the way that we’ve approached things, is going to massively accelerate their own development of the application of AI to their products. I think they saw that in us.

You’re right. There are a lot of folks out there who are developing against this technology. Harvey is one of them. But as we look at it, there are dozens of new companies coming into the space with AI capabilities. I do think it’s going to be a competitive market – a very competitive market – for having AI help people with legal work. And I think that they just wanted to work with the folks who are doing it at the top of the game. I think that’s at least a piece of it. And I say it with humility because it was really hard to get here, and the team put a lot of work to get to this place. And we know that in order to continue doing it best, we’re going to have to really continue to deeply invest and to not lose any sense of urgency or not get complacent. Now is not the time for that.

AMBROGI: You just mentioned that it’s going to be a really competitive market. One of my concerns is what the impact of this acquisition will be on the competitiveness of the market. Casetext has had a record of being one of the most innovative companies out there and driving innovations that other companies, including TR, have emulated. Assuming the deal closes, once you become part of TR, what happens? Does that make the market less competitive? Do you have any fear that you will be less innovative or less able to roll out the kinds of innovation you’re known for?

HELLER: I wouldn’t be doing this if I thought that might be the case. You know me. You’ve been covering us for a long time. If I was worried about that, we wouldn’t be walking into this deal. Frankly, we had too many other opportunities to do too many other things that, if we took that out of what we’re doing, I’d be really concerned. To the contrary, it’s quite the opposite. They’re bringing over the entire Casetext team, and they’re investing very heavily in this. We expect the amount of resources that we’ll be able to expend on innovation – not just monetary, but know-how and customer relations and content and everything else that TR provides – is going to accelerate rather than decelerate our rate of innovation. That’s exactly the intention.

I respect that, from the outside, some of these deals kind of look the same, right? But, being on the inside of it, we have gotten very confident, extremely confident, around what this will mean for our pace of innovation and what we’ll be able to accomplish, and we are really encouraged by the way that their leadership team is thinking about this and is thinking about what the next stage looks like.

I don’t think that us being a part of TR, accelerating our pace of innovation, is going to take out the competitive infants of the market. In some ways, I think, it’s going to raise the bar for the whole market about what can be possible, what can be done by this kind of technology. As you saw, just yesterday, Relativity said it is getting into generative AI. Harvey is obviously raising a lot of capital. EvenUp just raised $50 million in capital to provide something for plaintiffs’ attorneys. I think you’re going to see a ton of activity because this is one of the most exciting, most important moments in the history of legal technology, if not the most exciting moment of legal technology, I don’t think you’re going to see a bunch of people waiting on the sidelines or unable or unwilling to get in the fray. You’re seeing the exact opposite.

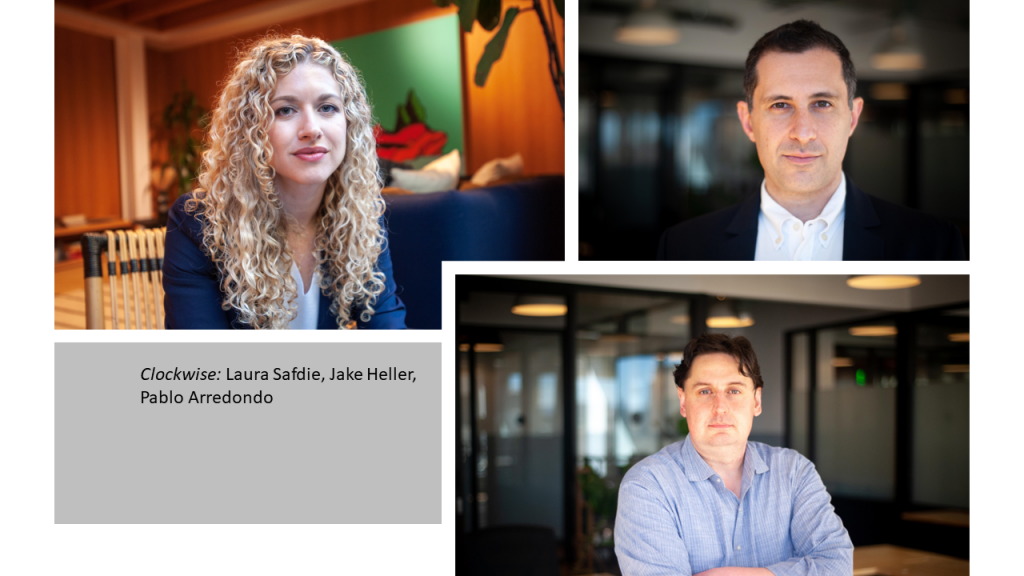

AMBROGI: Do you know yet what the roles will be for you and cofounders Pablo Arredondo and Laura Safdie?

HELLER: Obviously, some of the details have to be worked out as we reach closing. We are all joining – us and our chief technology officer and our chief revenue officer – as with the rest of the company. All of the employers are also joining. I do know that I’m going to be really focused on product and really focused on innovation, as will Pablo and as will my chief technology officer. I know that Laura is going to be really involved in managing the integration and running the operations of the business. And we know that they’re keeping a lot of the group together as part of one organization. They don’t want to change what’s working. Don’t fix what ain’t broke. But what they do want to do is put more resources in it. So I’d expect to see more people working on the same core technology with more resources, more content, more everything behind it after the transaction closes. That’s part of why we’re really excited about it.

AMBROGI: Part of the discussion at the investor call this morning was around the price tag, and a lot of the talk in the industry has been around the price tag. The Thompson Reuters executives on the call this morning made some allusions to the fact that your revenues are relatively modest, particularly in comparison to TR’s. And your product, your AI product, CoCounsel, is still a relatively new product. It was just brought to market, just released formally, four months ago. So how do you explain this price tag? How does this price tag make sense for the legal tech market?

HELLER: It’s a great question. I think part of it we brought our product to market incredibly quickly, and I think that’s something that they saw. I think it’s a competitive market to fund and acquire businesses. We know what we were getting offered from the likes of venture capitalists and so on, and I think that drove an understanding of what the market believes in terms of our potential. But I think the bigger picture here is the price tag reflects the upside of what they can do together, working with us. I think they saw that if you combine our technology and their content, their know-how, their customer reach, that the opportunity here was enormous and presumably even bigger in their eyes than the amount they’re investing in acquiring the business and will be investing in growing the business. So I think it speaks to their optimism for what we can accomplish together as a company.

AMBROGI: What happens with CoCounsel? To what extent have you had conversations with them about that? Do you see CoCounsel continuing as a standalone product or do you see that it becomes merged into however Thompson Reuters ends up incorporating this technology?

HELLER: What I think you’ve seen with Thompson Reuters and their track record is they’ve been very good about supporting products, oftentimes independently from the main product. A great example is Practical Law, that one can subscribe to hypothetically without being a Westlaw customer, without being otherwise a TR customer. We know that folks who are subscribing to products like CoCounsel are going to continue to have access to it exactly as they have, continue to subscribe to it exactly as they have. And my hope and expectation is a lot of the core underlying technologies we’ve been developing will, as their content and as their information improves CoCounsel – for example, CoCounsel leveraging Practical Law and Westlaw data to get smarter and better at what it does – I hope that some of our technology also bleeds over and makes the core Westlaw experience better and the core Practical Law experience better.

Something we’ve talked about extensively is that a lot of what we’ve done with our platform – some fundamental breakthroughs in the way that we handle this AI – also applies to tax and accounting and compliance and regulatory, and news through Reuters. So I expect that while they’re helping make our product better, we are going to help have an influence and an impact across all the professions they serve and the news. And that’s also something that got our team really excited – the opportunity to have such a broader impact based on the work they were doing and extend that influence across so much else.

AMBROGI: I know your time is short. Anything else that you’d like to say before we wrap up?

HELLER: You know, I’ve been doing this for a while and, as you know, there are certain things that we really care about as a company, right? We care about innovation. We care about our customers deeply. We really care, especially right now, about getting this AI technology right, about doing the best we possibly can for our customers during this time of what we believe is a shift in the history of legal technology. For us – and you know us – for us, the most important thing about this deal is whether we can continue that pace of innovation, about knowing that we can serve our customers better with this combination, that was a major driving force behind this.

If you were to take the mood within Casetext of the employees, part of why people are so excited about this – and a lot of them just found out for the first time themselves yesterday, because we had to hold that information close to the chest – is that we all know that we are in a better place together and we’re just so excited about that. I hope folks give us a shot to see what that looks like because I think they’re really excited and really impressed.

Our mission is around empowering attorneys to make their practices so effective and so efficient that they can, in turn, provide their clients with justice, right. Something we think a lot about on that point is whether we are serving our mission well for not reaching as many people as possible? There are very few companies in the world that can help accelerate the adoption of this technology, and the responsible adoption of this technology with the right training and guidance and set up, like TR. It’s a unique opportunity to help accelerate our mission.

AMBROGI: Again, a big congratulations to you, and thanks for taking the time out of what I’m sure is an extremely busy day to talk to me.

HELLER: Anytime.

Thomson Reuters, continuing to build on its acquisition last June of Casetext and its CoCounsel generative AI legal assistant for a whopping $650 million cash, today disclosed plans to deploy CoCounsel as a single and continuous AI assistant across its entire portfolio of products spanning every professional its serves in legal, tax, risk and fraud, […]

Thomson Reuters, continuing to build on its acquisition last June of Casetext and its CoCounsel generative AI legal assistant for a whopping $650 million cash, today disclosed plans to deploy CoCounsel as a single and continuous AI assistant across its entire portfolio of products spanning every professional its serves in legal, tax, risk and fraud, […]

Fast Company is out with its annual ranking of the world’s most innovative companies, and of the 606 companies that made the list, just four are from legal tech. “The 606 organizations that we honor as Fast Company’s Most Innovative Companies of 2024 have met our high bar for demonstrating innovation and the impact of […]

Fast Company is out with its annual ranking of the world’s most innovative companies, and of the 606 companies that made the list, just four are from legal tech. “The 606 organizations that we honor as Fast Company’s Most Innovative Companies of 2024 have met our high bar for demonstrating innovation and the impact of […] Still less than a year since it launched, CoCounsel, the generative AI legal assistant originally developed by Casetext, has had quite a year. Now, as it expands into new markets, we get details on its adoption to date. It was March 1, 2023, that Casetext launched CoCounsel, a product developed in partnership with OpenAI that […]

Still less than a year since it launched, CoCounsel, the generative AI legal assistant originally developed by Casetext, has had quite a year. Now, as it expands into new markets, we get details on its adoption to date. It was March 1, 2023, that Casetext launched CoCounsel, a product developed in partnership with OpenAI that […]

1.

1. 2.

2. 3.

3. 4.

4. 5.

5. 6.

6. 7.

7.

9.

9. 10.

10. 11.

11. 12.

12. 13.

13. 14.

14. 15.

15.

2.

2. 3.

3. 4.

4. 5.

5. 6.

6.

8.

8. 9.

9. 10.

10. 11.

11. 12.

12. 13.

13. 14.

14. 15.

15.